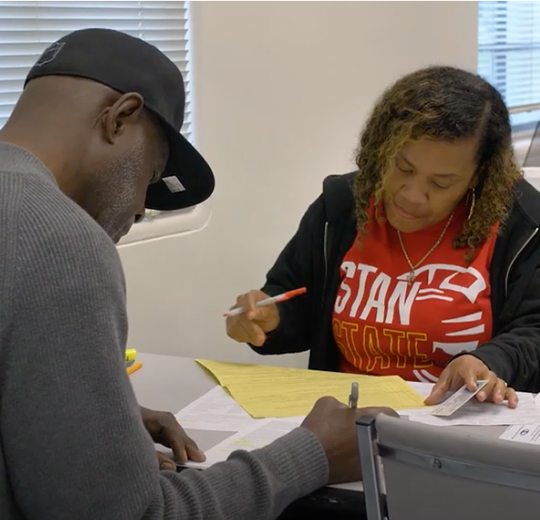

With Tax Day just around the corner, the Volunteer Income Tax Assistance (VITA) program is in full swing at the Stanislaus State Stockton Campus, helping community members navigate tax season while giving student volunteers important real-world experience.

An IRS-certified program that has been in operation for more than 50 years, VITA provides free tax preparation services for individuals and families who earn $68,000 or less annually, people with disabilities and limited English speakers.

The program location at the Stockton Campus is both a community resource and opportunity for Stan State students to gain experience in tax preparation and financial literacy.

In 2024, student volunteers completed 433 tax returns, securing $955,375 in total refunds and tax credits for local taxpayers. This included:

- $469,761 in federal refunds

- $146,603 in child tax credits

- $129,017 in state refunds

- $27,859 in state Earned Income Tax Credits

These refunds put dollars back into the community, providing financial relief to families and individuals who might otherwise struggle with tax preparation costs. When surveyed, 96% of those who used the free service said they would recommend it to others.

“VITA has been a game-changer for both me and my community,” said social science major Delilah Rice, who has volunteered for the program for the last two years. “It’s given me hands-on experience, which not only strengthens my skills but also helps people who truly need assistance.”

Rice said volunteering helps her contribute to the financial well-being of others while also gaining valuable knowledge.

Each filing season, VITA recruits and trains volunteers to provide tax preparation services. The Stockton VITA program has seen more appointments booked this year thanks to increased outreach. In 2024, the program had 13 volunteers. This year, participation more than doubled to 30 students from both Stan State and San Joaquin Delta College. All volunteers must pass rigorous tax law training that meets or exceeds IRS standards. Training includes maintaining taxpayers’ privacy and confidentiality. Additionally, volunteers must certify their knowledge of tax laws, and the IRS requires a quality review check for every tax return prepared.

The program at the Stockton Campus is led by Assistant Professor of Accounting Larry Barnes.

“VITA has been a rewarding experience,” Barnes said. “It allows Stan State to provide free tax assistance for Stockton residents, saving them hundreds of dollars in preparation fees for those who typically can't afford them. It’s fulfilling to provide a crucial service to the community.”

Barnes said the skills students learn in tax preparation can turn into an internship at a local or regional accounting firm or business establishment, leading to future employment. He added that accounting and finance jobs are among the 20 top-paid professions for graduates with a bachelor’s degree.

Community members can take advantage of the free tax preparation services every Saturday through April 12 by scheduling an appointment in advance by dialing 211. Services are available in Spanish and English. Taxpayers need to bring a photo ID and either a Social Security card or an Individual Tax Identification Number (ITIN). They must also submit W-2s, 1099s, tuition statements and other relevant tax documents at the appointment.

The program provides a valuable service to individuals while also reinforcing Stan State’s commitment to the region.

“This is great for the community and for Stan State,” said Stockton Campus Dean Sarah Sweitzer. “Not only does it grow education in our community, but it also grows economic impact and centers us as a community anchor that is engaged.”